We got too many gangsters doing dirty deeds

Too much corruption, and crime in the streets

It’s time the long arm of the law put a few more in the ground

Send ’em all to their maker and he’ll settle ’em down

Toby Keith and Willie Nelson

I sit in a ringside seat as a banker watching people manage their finances. I have witnessed many ways people are separated from their hard-earned money. Some are illegal. Some are legal, but unethical. And many, while legal and ethical, would be unnecessary with a little more knowledge about managing money.

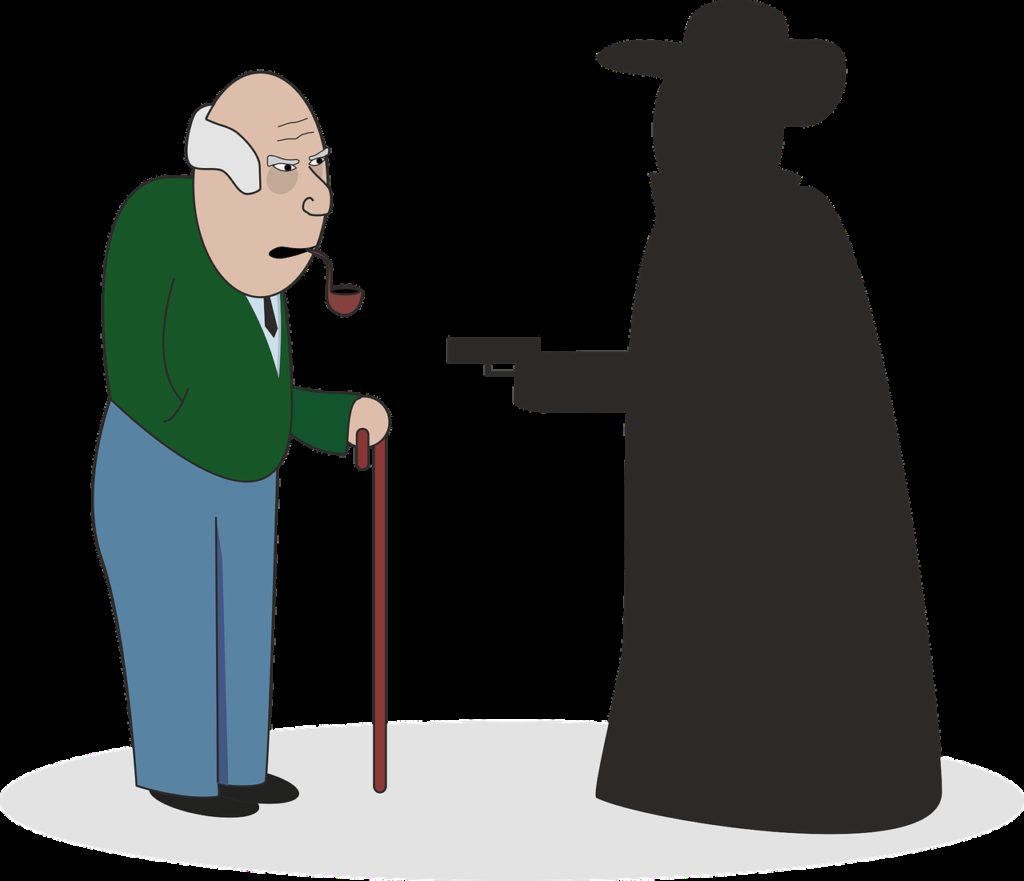

The most disturbing experiences for me are when shysters extract money from the naïve and innocent. I’ve seen the pain of customers who found out their elderly mother had given her life savings to a manipulative TV preacher. Unfortunately, there’s not a lot that can be done in those situations.

Even sadder are the lonely people who develop an online romance with someone overseas. To come to the U.S., someone convinced one of my customers to wire funds, so he could get a passport and airline ticket. But that wasn’t enough. Just send a little more he told her numerous times. Finally, the lightbulb came on that this might be a scam.

Or, you may have heard of the Nigerian prince scam? I didn’t believe any sophisticated person could fall for such a crazy scheme. But a customer of mine got a fax from a “prince” trapped in Nigeria. The fax promised if my customer, a CPA no less, would wire twenty thousand US dollars, it would allow the prince the ability to wire my customer millions. Unfortunately, my customer bought it and lost not only his money, but his reputation.

Rather than absorb the loss and move on, my customer decided to fly to Nigeria to “get his money back.” He didn’t get his money back, but at least he came back alive!

Today, many scams are high tech. Computer hackers making ransom demands to unlock vital computer systems are common. I’ve talked to businesses who have had to pay the ransom in Bitcoin, or see their business fail. As Willie Nelson sings, “We got too many gangsters doing dirty deeds.”

The Fear Factor

One of the earliest books I read on investing was “How to Prosper During the Coming Bad Years” in 1979. It scared me that we were on the brink of destruction. I didn’t have much money, but I bought gold mining stocks in countries I couldn’t even find on a map. As we entered into a great time of prosperity in the 1980’s, I learned that fear sells books and newsletters. But it doesn’t lead to clear thinking or prosperity.

Today marketers still seek to get your money through fear tactics. One of the latest is to emphasize how much of a bubble we’re in. I saw an economist’s newsletter last week that had an impressive array of charts all showing how the stock market is in a bubble. His pitch? The future doesn’t belong to passive low-cost index investors like me. Rather, I should turn my money over to him because he is going to be an expert stock picker as the markets crash.

However, as I look at the past ten years, I see headlines in all those years about how the market was in a bubble. Yet none of them turned out to be true. Here’s a sample:

May 3, 2011: Why this Market Looks like the Tech Bubble all Over Again Business Insider

December 2, 2013: Nobel Prize Winner Warn of US Stock Market Bubble CNBC

June 23, 2016: Un-Oh. Is the Stock Market in a Bubble Again? CNN Money

I could go on, but the point is, whenever you find yourself making a decision out of fear, ask yourself if you’re being manipulated by a sales strategy. Someday the markets will go down. But don’t let a fearmonger sell you something by playing on that concern. Structure your assets so you’re confident you can weather a downturn.

The Conflict of Interest for Money Managers

One of my favorite quotes about money is from Upton Sinclair who said, “It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

I saw this first hand a few years ago. I was a regional president at the time for a large bank. They gave me sales goals to refer business to the trust department. I was able to help a trust money manager secure a pension fund with tens of millions of dollars in it. It was a good account.

Each year the money manager would bring a host of colorful charts to the trustees of the pension plan and explain how well he had managed their money. In truth, the plan underperformed the broad market. But he was smooth. By the end of the meeting, he had the trustees convinced he had done a great job and that they were smart fiduciaries for hiring him.

After one of these meetings, I commented that they could eliminate his high six-figure fee and have better results by investing in low-cost index funds. He didn’t appreciate the comment. I realized one of the reasons he was such a good salesman was that he believed his own spin. As Sinclair noted, his fee depended on him not understanding the powerful argument for low-cost index fund investing.

The Cost to Outsource Your Wealth Management

There may be good reasons some people outsource managing their money. Some people may have no knowledge of financial markets or are too busy making money to manage it themselves. Those reasons are among those that make sense for paying money management fees.

But if you make a decision to let someone else manage your money, make it a point to understand the fees. It can be eye opening.

I did a little research last week on the fee schedules of two trust companies. My wife and I are getting around to updating our estate plan. I wanted to see the cost if something happened to me to let a trust department handled finances for my wife.

I’ll use $500,000 to illustrate. I already know the cost to keep our money in a diversified fund at Vanguard like the Total Stock Market index fund. Fees are 0.03% of the total invested. So, total fees would be $150 in this fund.

On the other hand, the Montana bank trust department would charge $6,000 in addition to any fees from the funds where they invest the money. So total fees could easily run $8,500 annually for the trust department to manage $500,000.

The national brokerage firm’s trust department is similar. Their fees would run $7,500 not including the fees from the funds. So total fees could easily be $10,000 a year or more depending on the fees assessed in the mutual funds or other assets.

I’m just a banker, not a rocket scientist, but I can calculate the difference between $150 and $10,000 pretty easily. But would my wife get a better return on our investments from active managers than I get keeping our money in Vanguard? Maybe, but if the last decade is a fair indicator, active managers have lagged the passive, low-cost approach consistently.

So, at a minimum, if you don’t want to do it yourself, understand the fees being charged and how your advisor is incented before turning your assets over.

It’s time to hit the send button. But this is an important topic for all of us and we can learn from each other. So, if you have a helpful story, I hope you’ll join the conversation and share it.

Joe Kesler

Smart…index funds no longer require the need for money managers…Vanguard manages your money for the lowest fee.

Thanks for the comment Mik. The world of investing choices just keep getting cheaper and better. Ignorance comes with a price these days. Appreciate the shout out to Vanguard. I use their funds, but I know there are many other good ones out there.

The bad actors who get paid to not know sound like politicians.

HaHa! Thanks David. I forgot to include those bad actors.

Joe, your points make sense, fear is not a good motivator, but caution might be. Our CFP found holes in our end-of-life plans that could have been costly. Also, he found a brokerage documentation error that is now going to return more tax money than his fee. I’m also well over 70 and agree with the recommendation that older people can get themselves in trouble trying to manage their own money. He also answers his phone. Now, if you lived across the street from me, I might rethink our money management strategy.

Excellent points Kirk! Most financial advisors provide valuable services. You have obviously found one of the good ones that is doing a great job for you. As long as they provide transparency on the fees they charge and provide value added services, they can be well worth it. Congrats on finding a good one!